Leveraging Value Chain Analysis for Mergers and Acquisitions

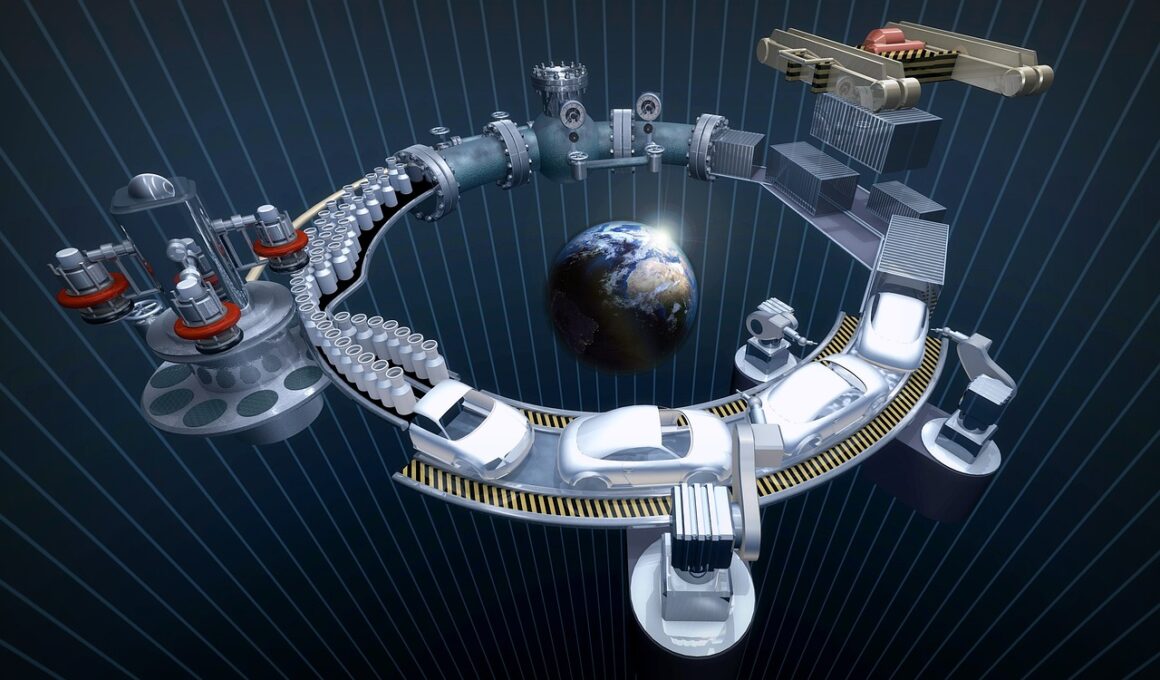

Value chain analysis is a critical tool in the field of strategic planning, particularly when organizations consider mergers and acquisitions. It helps in identifying how each activity within a company adds value to the product or service offered. By understanding the full scope of the value chain, businesses can make informed decisions that will optimize their operations. In the context of M&A, this analysis can reveal potential synergies between merging companies. When two companies join forces, assessing each segment of their value chains allows stakeholders to foresee where efficiencies can be realized. Moreover, this understanding highlights potential overlapping functions and identifies ways to streamline processes. As a result, companies can reduce costs and improve profitability. Additionally, a comprehensive value chain analysis can augment due diligence, revealing hidden costs or weaknesses in the acquired company. As companies explore different merger opportunities, this strategic approach ultimately fosters better-informed negotiations and business decisions. The alignment in value chains becomes integral to ensuring a successful post-merger integration, underlining the importance of valuing the proposed synergies offered by potential acquisitions.

Understanding the advantages and disadvantages of each company’s value chain is essential before any merger process. This ensures that decision-makers are fully informed about what they stand to lose or gain. Performing this analysis helps in assessing whether the acquisition aligns with long-term strategic goals. Identifying strategic advantages through value chain analysis involves evaluating core competencies, such as innovative capabilities, customer relationship management, and operational efficiency. Companies often acquire others not just for their market share but for their unique strengths that complement existing operations. Moreover, understanding cultural differences between two organizations becomes vital, as these differences can heavily impact the integration process. Companies must assess whether the value chains of each entity can work harmoniously post-merger. Such analysis allows management to recognize which aspects of either company would elevate the combined entity’s competitive position. Employees from both sides must also see the benefits that come from leveraging each other’s value chains. Through educating employees on collaboration’s prospective wins, enhanced morale and engagement will likely result. In essence, aligning value chains leads to productive integration that ultimately fuels growth and profitability for the combined company.

Identifying Potential Synergies

A critical aspect of leveraging value chain analysis for mergers and acquisitions is the identification of synergies. These synergies can significantly enhance the overall effectiveness and efficiency of the merged entity. By examining each component of the value chains, organizations identify areas where combining operations could result in cost savings or operational improvements. Common areas include shared resources, overlapping operational functions, and collaborative synergies in R&D. Synergies also extend to marketing and sales strategies that benefit from a combined customer base. Acquiring companies often visualize how much stronger they will be in the marketplace when leveraging the competencies present in both organizations. Identifying these crucial links early on ensures that management teams focus their efforts on integration strategies that capitalize on the strengths of both entities. This proactive approach can prevent operational redundancies and streamline processes. Additionally, thorough mappings of both companies’ value chains illuminate complementary strengths and weaknesses that can be addressed. As a final point, understanding synergies not only strengthens the case for a merger but also allows for a more strategic negotiation by highlighting the value creation potential that can be achieved through collaboration.

Moreover, in the integration phase of a merger, utilizing value chain analysis helps in developing a roadmap for change management. Change is often difficult for employees, and effective communication of how the merger aligns with organizational goals is essential. This roadmap should clearly define how each function across the integrated value chains will work. Involving employees from both sides in this process helps to garner buy-in and generates commitment to overcoming integration challenges. As teams become more familiar with one another, aligning their efforts and resources can result in creative solutions that benefit the merged organization. A structured approach to integration, guided by value chain analysis, fosters collaboration among employees from both companies. Additionally, it builds a unified organizational culture that is focused on achieving common objectives. This strong foundation is particularly critical during the initial stages following a merger since it influences overall employee morale and productivity. Companies that prioritize efficient integration foster an environment where innovations can thrive, ultimately driving the merged organization toward long-term success.

Post-Merger Strategy and Continuous Improvement

After completing a merger, ongoing analysis of the integrated value chain becomes crucial for ensuring sustained success. Regular reviews of the combined value chain can assure that the entities remain aligned with their strategic goals and objectives. This continuous assessment allows for adaptability in the face of shifting market conditions. Companies that monitor their performance can quickly identify areas for improvement, which is essential in maximizing the return on the merger. Furthermore, feedback from customers and stakeholders can inform ongoing adjustments needed to optimize performance. Open channels for communication ensure that insights gleaned from both value chains are appropriately considered in decision-making processes. Maintaining a focus on performance metrics based around the value chain also helps in identifying additional opportunities for efficiencies. Implementing learned practices across merged operational areas leads to enhanced customer satisfaction. Employees play a key role in this process, as their engagement is often the driving force behind innovation. Therefore, nurturing a shared vision fosters a culture of commitment, ultimately enabling the merged organization to adapt and thrive in a competitive landscape.

Effective use of technology in aligning value chains can also redefine operational effectiveness during and after a merger. Modern technological tools facilitate transparency, allowing seamless communication across functions and teams. Implementing integrated software systems assists in unifying processes between the merging companies, promoting an efficient transition. Such platforms enable real-time analysis of value chain components, making it easier to adapt strategies as necessary. Moreover, technology can significantly improve data collection and analysis capabilities. Organizations can gather insights around customer behaviors, production efficiencies, or market trends that directly influence their value chains. Investment in training and development equips employees with the skills needed to effectively utilize new technologies, ensuring that they are part of the value creation process. Managing resistance to change through effective training approaches fosters a culture of innovation and encourages the sharing of ideas. As companies leverage technology effectively, they open the door to continuous improvements and innovations that drive profitability in alignment with the value chain. Ultimately, understanding and utilizing value chain analysis through technology can position a merged organization for sustainable growth.

Conclusion

In conclusion, value chain analysis remains a vital aspect of strategic planning specifically for mergers and acquisitions. By examining each component of the value chains, organizations can identify synergies, develop integrative plans, and address cultural disparities. Effective use of this analysis not only guides companies during the M&A process but also lays the groundwork for favorable outcomes post-merger. Introducing structured change management processes and utilizing technology are key steps toward ensuring smooth transitions for merged entities. Continuous evaluation and improvement of the integrated value chain enhance adaptability in response to market dynamics. Furthermore, engaging employees during the merger helps in building a unified organizational culture that prioritizes shared objectives. As businesses maneuver through mergers and acquisitions, leveraging value chain analysis facilitates enhanced communication and collaborative efforts, allowing them to achieve long-term synergistic benefits. Therefore, to maximize the opportunities that arise from M&A activities, companies should prioritize conducting thorough value chain assessments. Ultimately, recognizing how to leverage these insights effectively can empower organizations to realize their strategic goals and set their sights on future growth.

Investing in this analytical approach can lead to immense value creation and solidify competitive advantages.