The Intersection of Supply Chain Finance and Risk Management

In today’s increasingly competitive environment, businesses face numerous challenges that impact their supply chains. As a consequence, understanding the intersection of supply chain finance and risk management is essential. These areas help organizations optimize financial resources while mitigating risks. By employing robust financial frameworks, businesses can navigate uncertainties that arise. In supply chain finance, securing capital becomes pivotal to maintaining smooth operations. However, risk management plays an equally crucial role by identifying potential threats that could disrupt supply processes. Businesses need to assess their suppliers and logistics networks to ensure stability. A strategic blend of finance and risk management can empower organizations to bypass common pitfalls. They should leverage technology to gain real-time insights into their supply chain dynamics. Furthermore, collaboration with financial institutions enables companies to enhance their financing options and conditions. This synergy facilitates advanced forecasting and analytical capabilities necessary for informed decision-making. Thus, integrating finance and risk management practices can foster a resilient supply chain capable of adapting to fluctuations and disruptions in the marketplace. Companies that prioritize this intersection stand to gain significant advantages over competitors in the industry.

Notably, effective risk management strategies in supply chain finance must focus on a comprehensive analysis of the entire supply chain ecosystem. Organizations should identify potential vulnerabilities and assess their impact on business performance. A holistic view allows decision-makers to pinpoint specific areas requiring attention while establishing tailored risk mitigation strategies. By prioritizing a proactive risk management approach, companies can anticipate market fluctuations and adapt their strategies accordingly. Furthermore, organizations must engage in continuous monitoring of market conditions and regulatory developments to stay ahead of potential risks. Collaboration with suppliers and partners can help in sharing crucial data that informs better financial strategies. Establishing a transparent communication channel is necessary to develop trust and report any issues promptly. Businesses often find value in adopting advanced technologies such as artificial intelligence and big data analytics to enhance their forecasting capabilities. These tools allow for quick adjustments in response to changing conditions, promoting agility in supply chain finance. Effective integration of these technologies into existing frameworks can lead to significant improvements in operational efficiency and reduce costs while also improving cash flow management.

Understanding Financial Instruments in Supply Chain

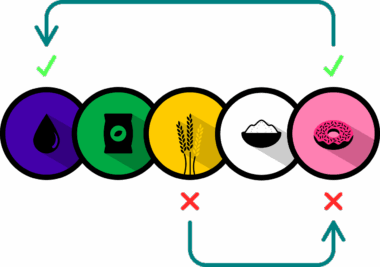

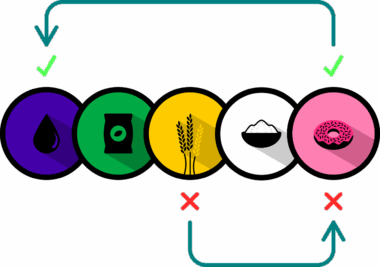

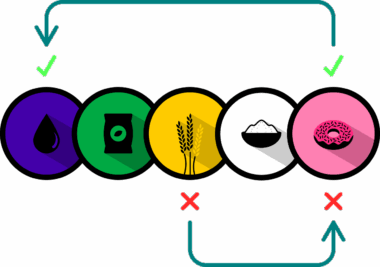

Moreover, financial instruments utilized in supply chain finance need to be understood thoroughly to maximize their potential. These tools include trade credit, factoring, reverse factoring, and inventory financing. Each option serves a distinct purpose in addressing liquidity challenges faced by suppliers and manufacturers. Trade credit enables businesses to purchase goods and services with deferred payment, benefiting both parties involved. On the other hand, factoring allows companies to convert their receivables into immediate cash by selling them to a third party. Reverse factoring, alternatively, lets buyers support their suppliers by providing early payments through financial intermediaries generating trust. Lastly, inventory financing provides businesses with capital using their inventory as collateral, thus enhancing working capital. In navigating these financial instruments, decision-makers should weigh the pros and cons according to their specific risk tolerance and operational requirements. Furthermore, implementing effective management systems ensures correct alignment with the overall financial strategy and risk management framework. Consequently, organizations that embrace a comprehensive understanding of these tools can optimize their financial health while mitigating risk exposure throughout the supply chain.

Furthermore, establishing strong relationships with financial partners can enrich a company’s supply chain finance and risk management capabilities. Solid ties with banks, credit institutions, and insurance providers enhance access to crucial financing options. These connections often facilitate better repayment terms, leading to enhanced cash flow management. Financial partners can serve as trusted advisors, assisting businesses in navigating complex financial environments. They help analyze risk profiles and craft financing solutions tailored to specific business models. Organizations benefit from leveraging the expertise of their financial partners, unlocking opportunities for operational efficiencies. Collaborative efforts can lead to investments in technology and infrastructure that enhance visibility and transparency throughout supply chains. Moreover, a shared focus on sustainability can enable organizations to minimize their environmental impact while addressing risk management goals. A robust financial partnership ensures that businesses are prepared to tackle uncertainties, strengthening their overall resilience. Investing time in cultivating substantial relationships with these partners is essential for organizations looking to thrive in turbulent financial climates. The partnership should complement both the supply chain finance strategy and risk management practices to deliver tangible results.

The Role of Technology in Supply Chain Risk

Additionally, technology plays a vital role in transforming supply chain finance risk management through enhanced data analytics and visibility. By leveraging advanced technologies like blockchain, organizations can improve transaction security and traceability. Blockchain technology allows for transparent information sharing among all parties involved in the supply chain. This fosters trust and minimizes fraud, confirming the integrity of financial transactions. Furthermore, data analytics enables businesses to gain actionable insights from massive amounts of information, thereby enhancing risk assessment processes. These technologies optimize inventory management, forecasting accuracy, and the ability to identify potential disruptions timely. Real-time alerts regarding operational risks empower organizations to respond swiftly and effectively. Moreover, implementing machine learning algorithms can automatically evaluate historical data to predict future patterns and risks associated with financing decisions. As businesses integrate these technologies into their frameworks, they pave the way for innovation and efficiency in supply chain finance. The effective use of technology reduces compliance issues and aligns financial strategies with risk management objectives, ensuring sustainable growth. Companies that effectively adopt these technological solutions will emerge as leaders in supply chain resilience.

Despite the undeniable importance of integrating supply chain finance and risk management, organizations must overcome various challenges. One of the primary obstacles is the existing silos within organizations, which complicate collaboration between finance and supply chain teams. Such silos hinder effective communication and information-sharing processes crucial for informed decision-making. Companies must foster a culture of collaboration and encourage cross-functional teams to work towards common objectives. Additionally, workforce training should be prioritized, enabling employees to understand the intricacies of supply chain finance and risk management. Every team member needs an awareness of how their actions impact the overall system, promoting accountability. Another challenge involves the constantly evolving regulatory environment surrounding financial practices. Organizations must remain vigilant, continuously updating their knowledge and practices to align with current regulations to minimize exposure to legal risks and penalties. Embracing flexibility in their operational procedures ensures companies can pivot quickly in response to changes. As organizations strive to navigate these challenges, effective change management strategies will be necessary. Emphasizing adaptability and resilience will ultimately lead to successful integration of supply chain finance and risk management.

The Future of Supply Chain Finance and Risk Management

Looking ahead, the future of supply chain finance and risk management holds significant promise. As technology continues to advance, organizations will increasingly leverage automation and artificial intelligence. This will further streamline financial processes and enhance risk identification measures. Enhanced predictive capabilities will allow businesses to respond proactively to potential disturbances. Supply chain ecosystems will strengthen, fostering a climate in which collaboration thrives across various sectors. Additionally, sustainability will play a pivotal role as more companies align their financial practices with environmentally conscious strategies. Firms that adapt to these changes will enjoy not only competitive advantages but also gain respect from consumers and stakeholders. Integrating sustainability into financing decisions will likely lead to improved supply chain performance. Furthermore, the globalization of markets will continue to present both risks and opportunities. Organizations that navigate this landscape will find new avenues for growth and innovation. Therefore, companies must remain agile in their strategies, constantly seeking improvements in both supply chain finance and risk management. The intersection of these two domains will become increasingly critical for achieving long-term success, ensuring organizations remain resilient against any financial storms that may arise.

In conclusion, the intersection of supply chain finance and risk management is a critical area for any organization aiming to thrive in today’s dynamic marketplace. By understanding and integrating these two essential components, businesses can enhance their operational efficiency and mitigate risks. A strategic approach involves engaging with financial partners and leveraging technology for better data management and decision-making. As companies encounter evolving challenges and uncertainties, adopting a proactive stance on risk management becomes imperative. Furthermore, fostering a collaborative culture and breaking down the silos within organizations ensures holistic financial strategies that enhance risk awareness. Organizations should prioritize sustainability as both a financial and operational goal to attract consumers. The steps businesses take today to align supply chain finance and risk management will dictate their resilience in the face of future market fluctuations. Ultimately, organizations where these areas seamlessly integrate position themselves as industry leaders, equipped to tackle potential disruptions and capitalize on emerging opportunities. Future readiness relies on strong foundations built through careful planning, continuous learning, and insightful partnerships.