Limitations of Fundamental Analysis in Modern Investing

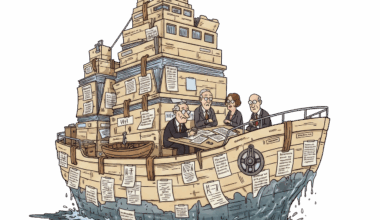

Fundamental analysis is a traditional method used to evaluate the intrinsic value of securities, relying extensively on financial statements, economic indicators, and industry conditions. However, the modern investing environment introduces several limitations to its effectiveness. One major limitation arises from the overwhelming amount of information available today, which can easily overwhelm investors. Trying to analyze vast datasets can lead to decision paralysis, where an investor fails to act due to analysis overload. Moreover, this information often contains noise that can distract from more relevant data points. In addition, the rapid pace of technological advancements means that companies can change significantly in a short time, making historical data less reliable. Different sectors may respond uniquely to trends or disruptions, complicating accurate analysis. Furthermore, the behavior of market sentiment and public perception can drastically affect stock prices, often irrespective of fundamental valuations. In such a scenario, reliance solely on fundamental analysis may lead investors astray if they ignore these psychological aspects. Thus, navigating the complexities of modern finance without considering both quantitative and qualitative factors can be quite challenging.

Another limitation of fundamental analysis is its inherent lag in reflecting market realities. While fundamental metrics provide valuable data, they often represent past performance rather than future potential. Investors may fall into the trap of relying too heavily on historical data, such as past earnings or revenue growth rates, which can mislead their predictions for future performance. Markets can be driven by news and events, which transcend conventional financial metrics. For example, a company may unexpectedly announce a merger or product launch, drastically altering its valuation prospects, even before the impacts of this news are evident in financial statements. Market reactions to such announcements can be swift and significant, rendering fundamental analysis outdated almost instantly. Additionally, fundamental analysis can often overlook external factors such as regulatory changes or global economic shifts that can affect an industry. Investors who ignore these external influences might miss critical shifts in the value proposition of their investments. In an era where speed matters, relying only on fundamental analysis can create a disconnect from the macro landscape driving equity valuations.

Subjectivity in Interpretation

One of the challenges with fundamental analysis lies in the subjective nature of interpreting financial data. Different analysts may draw varying conclusions from the same set of financial metrics, leading to disparate recommendations. Factors such as assumptions about future growth rates, margins, and discount rates can significantly influence valuations. This subjectivity can create confusion in the market, as investors grapple with conflicting opinions on a stock’s value. As a result, relying solely on fundamental analysis might not provide the objectivity that some investors require. Additionally, fundamental analysis often necessitates that analysts have deep expertise in their sectors to make accurate appraisals. This level of expertise can take time to develop, thus limiting its accessibility for beginner investors. Moreover, information asymmetry can also play a role, where some analysts have access to insights that others do not, leading to disparities in analysis outcomes. Such discrepancies can pose risks if individual investors base their decisions solely on published research without understanding the potential biases involved. Therefore, understanding these limitations is crucial for forming a balanced investment strategy.

Another concern is that fundamental analysis tends to focus heavily on quantitative data, which can lead to an incomplete picture. Financial ratios and metrics such as Price-to-Earnings (P/E) and Earnings Before Interest and Taxes (EBIT) provide essential insight into company performance but do not encompass everything. They often ignore qualitative aspects of a business, such as management effectiveness, brand value, and customer loyalty, all of which are intangible drivers of success. A company with excellent quantitative metrics may struggle with brand perception or customer satisfaction, significantly impacting its long-term viability. Therefore, merely looking at numbers can obscure key risks that traditional analyses frequently miss. As investors, it is essential to incorporate qualitative factors into the decision-making process for better-rounded views. Evaluating a company’s competitive positioning, industry trends, and management strategies can provide insights that data alone cannot offer. In today’s dynamic investment landscape, understanding both quantitative and qualitative aspects is vital in making informed investment choices. Ignoring one can lead to poor decisions and potentially financial losses.

The Role of Market Sentiment

Market sentiment plays a pivotal role that fundamental analysis can overlook. Investors often make decisions based on emotion rather than hard data. During a bullish phase, stocks with poor fundamentals may still rise due to collective optimism or hype. Conversely, during bearish phases, fundamentally sound stocks can plummet in value due to fear or panic selling. This suggests that fundamental analysis alone may lead investors to misinterpret the actual market conditions affecting stock prices. In today’s fast-paced trading environment, the influence of social media and digital news is significant. Rumors can spread quickly, creating waves of buying or selling that do not correlate with a company’s fundamental value. Such behaviors present a challenge that fundamental analysis struggles to address, as it often lags behind public perception. Investors need to strike a balance between quantitative analyses and a careful assessment of market sentiment, ensuring they do not become overly reliant on one aspect. By incorporating both dimensions, investors can better navigate the complexities of modern markets while minimizing risks related to emotional trading.

Another limitation is that fundamental analysis may lead to an overemphasis on anchoring bias. This cognitive bias occurs when investors rely heavily on the first piece of information they acquire, making them resistant to adjust their views when new data emerges. Investors heavily focused on historical metrics may become anchored to outdated perspectives, failing to react appropriately to changing circumstances. For instance, if a company consistently delivers strong earnings but suddenly faces significant obstacles, an investor fixated on past performance may ignore warning signs of financial distress. This can result in delayed selling decisions and substantial losses, as they become so tied to previous evaluations that they fail to reassess the situation objectively. Such biases can hinder rational decision-making, especially when volatility characterizes the markets. Diversifying information sources and challenging initial assumptions are essential strategies to counteract anchoring bias. By incorporating regular portfolio reviews and remaining open to new information, investors can enhance their analytical frameworks and avoid the pitfalls of cognitive biases that may undermine their strategies.

Conclusion: A Balanced Approach

In conclusion, while fundamental analysis remains a cornerstone of assessing investment opportunities, its limitations must not be overlooked. The combination of information overload, market sentiment influence, and subjectivity can lead to pitfalls for investors who rely solely on traditional methods. Moreover, the cognitive biases that affect investor perception further complicate the landscape. Therefore, a balanced approach that integrates both fundamental analysis and considerations of market dynamics is vital. Investors should adopt a comprehensive strategy that includes quantitative and qualitative analyses, enabling them to spot valuable opportunities and mitigate risks. Continuous learning and adapting to evolving market conditions can enhance the effectiveness of investment strategies. Knowledge of various analytical frameworks will empower investors to make more informed decisions in the competitive financial arena. By fully grasping the limitations of fundamental analysis, investors can better equip themselves for success in today’s increasingly complex investment environment.

There is also a need to supplement fundamental analysis with tools such as technical analysis, behavioral finance understanding, and even macroeconomic indicators for a holistic picture. Investors who remain adaptable, open to diverse analytical methodologies, will find themselves more resilient in fluctuating markets. Incorporating diverse strategies can protect against volatility and enhance long-term profitability. Ultimately, acknowledging the limitations while championing a more dynamic investment strategy can foster a more prosperous investment experience.