The Impact of Budget Deficits on Corporate Strategies

Budget deficits can significantly influence corporate strategies as companies must navigate a landscape shaped by government fiscal policies. When a budget deficit occurs, the government may be compelled to borrow money, leading to higher interest rates. As a result, corporations often face increased borrowing costs, which may alter their investment strategies. Companies might think twice about expanding operations or launching new projects. Furthermore, to buffer against uncertain economic conditions, firms might prioritize maximizing cash reserves. Additionally, as government spending potentially shifts towards deficit reduction, firms reliant on government contracts could experience fluctuations in revenue. This situation can significantly affect business forecasting and planning efforts. Furthermore, as government spending becomes restrictive, corporations may need to adjust operational strategies to maintain profitability. This could include cutting costs, increasing efficiency, or innovating product lines to adapt to changing consumer demands. The overall economic climate created by budget deficits can force companies to reevaluate their long-term strategies and responsive actions. Understanding the implications of fiscal policies is crucial for businesses trying to maintain growth amid fiscal challenges that disrupt traditional financial practices.

Corporate tax planning also faces challenges during times of budget deficits. Often, to close budget gaps, governments consider increasing taxes. This can influence corporate behavior as companies strategize around tax liabilities. As corporations anticipate potential tax hikes, they might accelerate the realization of profits to avoid higher future rates. This behavior can disturb long-term strategies geared towards sustainable growth. Consequently, businesses may also consider relocating to regions with more favorable tax conditions, which can lead to economic implications for their home markets. Moreover, an environment of budget deficits often leads to increased scrutiny from investors regarding a firm’s financial health. Investors may demand higher returns as perceived risks elevate. To retain investor confidence, companies might focus more on short-term outcomes rather than long-term commitments. Additionally, firms may engage in increasingly aggressive accounting practices to showcase strong earnings in the short run. This approach, however, can affect corporate reputation and long-term sustainability. Ultimately, navigating tax implications during budgetary constraints requires careful planning and strategic agility to adapt to fiscal changes and investor expectations in an increasingly competitive landscape.

Shifts in Consumer Spending Behavior

Budget deficits can contribute to changes in consumer behavior that significantly affect corporate strategies. Economic uncertainty often connected to high deficits can lead consumers to tighten their spending. Individuals may prioritize saving or shift their expenditure toward more essential goods and services. Businesses must, therefore, adapt to these changes by adjusting product offerings and marketing approaches. Companies might pivot their focus towards cost-effective solutions, emphasizing value and affordability in their communications. Furthermore, brands may need to engage in competitive pricing strategies in response to shifts in buying patterns among consumers. This emerging sensitivity can lead corporations to explore innovative ways to deliver products that meet tighter budgets. Additionally, firms may enhance online marketing efforts to tap into consumers that are increasingly price-conscious. Companies will need to prioritize data analytics to understand evolving consumer preferences effectively. By doing so, they can adapt inventory management and optimize supply chains accordingly. Moreover, engagement with customers through feedback channels becomes crucial, enabling corporations to align their strategies with shifting demands. Businesses that fail to adjust to these economic indicators risk losing market share in an increasingly challenging landscape characterized by budgetary constraints.

In a context of budget deficits, businesses must also assess the potential impacts on their workforce strategies. Companies might face pressures to limit salary increases or freeze hiring as a cost-saving measure during fiscal austerity periods. This could lead to a decline in employee morale and productivity if not managed effectively. Furthermore, budget constraints may compel organizations to reconsider employee training and development investments, which are vital for long-term strategic success. Firms must weigh the immediate financial benefits against potential risks associated with underdeveloping their workforce. Corporate strategies should therefore emphasize the stability of core teams while maximizing existing talent. Additionally, companies may explore flexible working arrangements or restructuring processes that align with a tighter budget. This adaptability ensures that firms remain competitive while responding to economic fluctuations. Furthermore, performance-based incentives could become more prevalent to motivate employees during uncertain fiscal times. Holding regular communication with employees regarding the company’s financial health is vital for maintaining transparency and trust. Emphasizing shared goals, even in challenging economic climates, creates a resilient organizational culture capable of navigating through periods of fiscal instability.

Investment Strategies under Fiscal Constraints

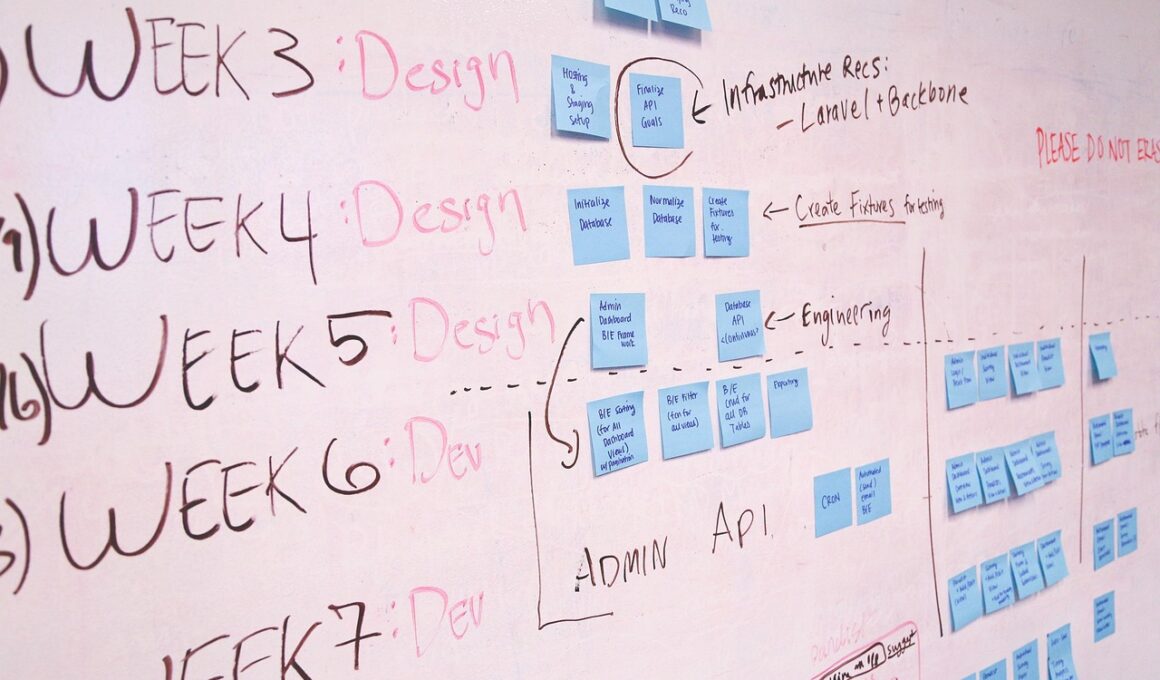

The approach to investment strategies generally transforms in response to budget deficits. When government deficit levels rise, they can constrain overall economic growth expectations, impacting corporate decisions regarding capital allocation. Companies often become cautious about long-term investments, analyzing risks more stringently due to a constrained fiscal outlook. This heightened risk aversion can lead corporations to pivot their frameworks, opting for lower-risk projects with quicker returns instead of long-term initiatives. Additionally, firms may reconsider joint ventures or partnerships, weighing potential benefits against the backdrop of government fiscal policies and their implications. Furthermore, investment in technological advancements could potentially face cuts, inhibiting innovation capabilities as organizations aim to maximize short-term financial performance over future growth. Corporations actively monitoring fiscal policies will be better positioned to anticipate changes and adapt their strategies accordingly. By prioritizing flexibility amid uncertainty, companies can engage in responsive strategizing that safeguards their market position. Thus, developing an investment portfolio that factors in both short- and long-term scenarios is vital in navigating through turbulent economic times marked by fiscal challenges and budget deficits.

Budget deficits often trigger regulatory shifts that influence corporate strategies. Governments may respond to increasing deficits by considering regulatory reforms, especially in sectors heavily influenced by fiscal policies. Companies in regulated industries, such as healthcare and energy, might experience more immediate impacts as policy shifts unfold. As regulations tighten in response to budgetary pressures, firms must adapt their compliance strategies, potentially increasing operational costs. This could include reassessing supply chains to mitigate compliance risks while maximizing efficiency. Corporations may also enhance their advocacy efforts to navigate changing regulatory environments affecting their operations. Engaging with policymakers to influence upcoming regulations can help firms align their strategies with evolving expectations. Moreover, companies introducing transparent practices could improve relationships with regulators, fostering trust and cooperation. They might also invest in compliance technologies to streamline processes and minimize risk exposure. Ultimately, being proactive in understanding the regulatory landscape becomes critical for companies, enabling them to formulate effective strategies that facilitate growth while obeying the laws related to government spending and fiscal responsibility. Adaptability becomes a key asset in protecting business interests in fluctuating fiscal climates.

The Role of Innovation in Response to Budget Deficits

During fiscal constraints imposed by budget deficits, innovation emerges as a vital component for survival and growth for many organizations. Companies frequently respond to budget challenges by exploring innovative solutions to maintain competitiveness. This could involve rethinking product lines or leveraging technology for operational efficiencies. By fostering a culture of innovation, organizations can enhance adaptability to ever-changing fiscal conditions. Furthermore, investing in research and development can lead to breakthroughs that position firms favorably amid budgetary restrictions. Moreover, innovation isn’t solely limited to new products but can also encapsulate business model transformations that create new revenue streams. Organizations may consider strategies that emphasize sustainability, allowing them to align with evolving consumer preferences and regulatory trends. Collaborations with startups or other innovative enterprises can broaden capabilities, allowing firms to capitalize on fresh ideas beyond internal teams. Fostering an innovative mindset is essential in responding dynamically to external pressures brought by budget deficits. However, balancing innovation investments against immediate fiscal realities requires a strategic approach that evaluates risk versus reward effectively, ensuring organizations thrive even in challenging budgetary environments.

Analyses of budget deficits also emphasize the importance of strategic communication for businesses. External communication becomes crucial as firms navigate the corporate landscape amid fiscal uncertainty. Maintaining transparency with stakeholders regarding strategic decisions influenced by budgetary pressures can build trust. Companies may actively engage with investors, employees, and customers to communicate their plans for navigating common fiscal challenges. They can highlight adjustments in corporate strategies and their rationale, ensuring that stakeholders feel informed and valued. Moreover, financial reporting becomes critical during budget deficits, with demands for clarity increasing. Shareholders expect detailed insights into how the fiscal environment affects operational efficiencies and profitability. Companies must effectively communicate the steps taken to mitigate risks associated with budgetary constraints. Additionally, organizations leveraging digital channels for engagement can amplify their messages, reaching broader audiences. By adopting a transparent communication approach, firms can enhance their credibility and stakeholder relationships. In increasingly complex environments, effectively navigating budget deficits through strong communication practices can influence perceptions and long-term business success. Thus, ensuring a proactive approach to communication is vital for providing reassurance and maintaining stakeholder confidence during periods of economic uncertainty.