The Future of Integrated Reporting: Combining Financial and Sustainability Data

In an era marked by increasing environmental consciousness, businesses are under mounting pressure to provide clarity on their sustainability initiatives. Integrated reporting emerges as a vital framework that bridges financial performance with sustainability metrics. This approach enables organizations to reflect their long-term strategy effectively while addressing various stakeholder demands. Stakeholders, ranging from investors to employees, require accessible information. Integrated reporting fulfills this need by offering a comprehensive overview of a company’s impact on society and the environment. Additionally, the framework facilitates better decision-making, as it consolidates disjointed reports into a single, coherent narrative. This integration enhances transparency and accountability, essential values in contemporary corporate environments. Adopting such practices may enhance public perception and foster trust among consumers. Furthermore, businesses that implement integrated reporting can gain a competitive advantage, as they demonstrate their commitment to sustainable practices. In this way, companies can respond adeptly to changing regulations and expectations surrounding sustainability. Ultimately, effective integrated reporting will drive meaningful changes toward responsible business practices that align with the ongoing transition to a sustainable future.

Companies must consider various metrics to ensure that integrated reporting accurately reflects both financial and sustainability performance. These metrics include environmental impacts, social responsibilities, and governance standards. By quantifying these elements, organizations can provide a holistic view of their performance. Furthermore, they can conduct analyses to reveal correlations between financial and non-financial outcomes. For example, a company assessing the costs related to waste management may unveil potential financial gains through improved sustainability practices. This approach not only aids in fostering corporate social responsibility but also enhances profitability. Implementing metrics derived from frameworks such as the Global Reporting Initiative (GRI) can standardize evaluation methods. Utilizing universal metrics enables organizations to benchmark performance against industry peers and drive continuous improvement. Stakeholder engagement also plays a crucial role in defining relevant metrics that align with public expectations. As stakeholder interests evolve, businesses must remain flexible and adapt their reporting practices accordingly. Stay aware of emerging trends to enhance both metrics used and data collected. Integrating financial and sustainability metrics not only meets accountability demands but also positions organizations as leaders committed to impactful social change in the long run.

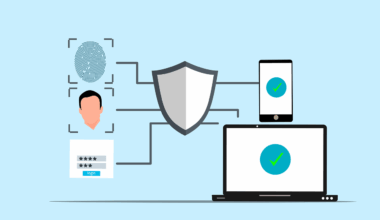

The Role of Technology in Integrated Reporting

The advent of advanced technologies has significantly influenced the landscape of integrated reporting. Businesses leverage data analytics, artificial intelligence (AI), and blockchain to enhance transparency and streamline information dissemination. These innovations facilitate real-time data tracking, enabling organizations to report promptly on their sustainability initiatives. The implementation of data analytics transforms raw data into meaningful insights that drive decision-making. Companies can analyze patterns and trends within their operational practices, ultimately guiding improvements. For instance, utilizing AI can optimize resource usage, leading to reduced emissions, all of which may be incorporated into the reporting framework. Additionally, blockchain technology assures data security and authenticity, bolstering the reliability of reports. By providing an immutable record of transactions, organizations can instill confidence in their stakeholders regarding reported performance. Furthermore, digital platforms can aid in distributing integrated reports through engaging visuals and interactive elements. This transition to tech-driven reporting processes aligns with modern consumer preferences, making information more accessible and digestible. As technology continues to evolve, its integration into reporting mechanisms will remain crucial for fostering transparency and dynamic corporate communication.

Investors are increasingly recognizing the importance of sustainability metrics in their decision-making process. Environmental, social, and governance (ESG) factors play a significant role in investment strategies as stakeholders aim to align their values with their financial choices. The shift towards sustainable investing has compelled companies to adopt integrated reporting. By incorporating sustainability data alongside financial performance, organizations can effectively communicate their commitment to responsible practices. This reporting approach also attracts a growing number of socially-conscious investors interested in supporting businesses aligned with their principles. Moreover, research suggests that companies with robust sustainability practices often outperform their competitors, indicating a clear link between these factors and financial success. Investors are demanding greater transparency regarding how companies mitigate risks related to climate change and social issues. In response, organizations that adopt integrated reporting can demonstrate their proactive approach to tackling these challenges. This alignment between investor expectations and integrated reporting further illustrates the critical importance of these practices in the modern business landscape. As a result, the focus on sustainability will continue to shape the narratives surrounding financial performance in corporate reporting.

Challenges in Implementing Integrated Reporting

Despite its numerous benefits, companies face challenges in implementing integrated reporting. One major obstacle is the lack of standardized frameworks to guide the integration process. Organizations may struggle to determine which metrics to prioritize and how best to present them cohesively. Varying stakeholder expectations can also complicate reporting efforts, as different groups may seek distinct information. Additionally, internal resistance to change can hinder the adoption of integrated reporting practices. Employees accustomed to traditional reporting methods may find it challenging to embrace new approaches. To address these challenges, companies must invest in employee training and education to foster a culture of transparency and accountability. By engaging teams across the organization, businesses can assure alignment with integrated reporting goals. Furthermore, collaboration with external consultants or industry experts can provide valuable insights into best practices. Companies should also adopt technology to streamline data collection and reporting processes, making information accessible and coherent. Ultimately, overcoming these barriers is essential for realizing the full potential of integrated reporting. Embracing this approach will pave the way for enhanced business sustainability and stakeholder trust.

Future trends in integrated reporting indicate a shift towards greater stakeholder involvement in the reporting process. Encouraging collaboration with stakeholders will not only enhance transparency but also provide valuable feedback to companies. This input can shape the direction of sustainability strategies and refocus efforts toward areas of significant impact. As more businesses embrace integrated reporting, best practices will emerge, fostering collective learning within industries. Continuous improvement will be essential for adapting to new expectations regarding sustainability reporting. Moreover, regulatory frameworks may evolve, pushing organizations to adopt comprehensive reporting practices. Governments are increasingly mandating disclosures related to sustainability, pushing companies to prioritize integrated reporting methods. Adopting such practices voluntarily can help businesses stay ahead of regulatory changes while positioning themselves as leaders in sustainability. The ongoing integration of financial and sustainability data will also drive innovation within corporate structures. With an emphasis on performance and accountability, organizations may develop new business models or adapt existing ones to promote sustainability. In conclusion, the future of integrated reporting is likely to shape the way organizations define success, prioritizing sustainable practices alongside financial performance.

In summary, integrated reporting is pivotal for organizations aiming to communicate their sustainability efforts alongside financial data. By incorporating various sustainability metrics, businesses can offer a comprehensive view of their performance, enhancing transparency and accountability. The role of technology, including data analytics and blockchain, supports the process, ensuring accurate and trustworthy reporting. Consequently, businesses are increasingly recognizing the necessity for strong sustainability practices, responding to stakeholder demands for clarity and assurance. Greater investor focus on ESG factors underscores the importance of adopting integrated reporting methods as a pathway to meet changing expectations. Although challenges persist, they can be addressed through employee engagement and external collaboration. Future trends indicate that stakeholder involvement will become integral to the reporting process. Organizations that successfully navigate these dynamics will likely gain a competitive edge, fostering trust and alignment with evolving consumer and investor sentiment. As integrated reporting evolves, the potential for businesses to thrive while balancing financial and sustainability goals remains promising. Ultimately, companies committed to effective integrated reporting will lead the way toward a more sustainable and responsible business landscape.