Navigating the Legal Obligations of Business Loans and Grants

When considering funding options for your business, it’s essential to understand the legal obligations associated with both business loans and grants. Business loans require repayment, typically with interest, creating a financial commitment that must be taken seriously. This commitment means companies need to maintain cash flow to meet repayment schedules. Other obligations may include ensuring that loan funds are used as specified in the agreement. Failing to meet these requirements can lead to severe legal consequences, including damage to credit scores and potential legal action. In contrast, grants generally do not require repayment, making them an appealing option for businesses. However, accessing a grant can often mean adhering to strict guidelines. Recipients may need to demonstrate compliance with certain regulations, such as maintaining specific performance targets or submitting regular reports documenting the use of awarded funds. Understanding these requirements is critical to avoid penalties or losing grant funding. Therefore, it’s crucial to weigh both the benefits and responsibilities of loans and grants when exploring funding routes for your business.

The Difference in Funding Structures

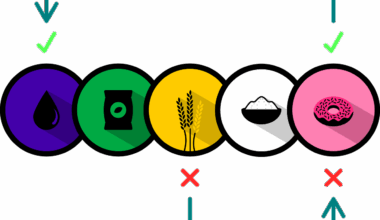

Understanding the structural differences between loans and grants is pivotal for businesses seeking financial support. Loans are financial products that provide capital borrowers must repay over a set period with interest, making them a valuable resource for immediate operational needs. They can be structured as short- or long-term financing based on the business’s needs. Conversely, grants are typically monetary awards provided by governments or organizations to assist in business development without the expectation of repayment. Due to their non-repayable nature, they often come with a competitive application process. Successful applicants can receive substantial funds, fostering growth and innovation. However, obtaining a grant often requires demonstrating the project’s social impact or other benefits, leading to rigorous scrutiny. Businesses need to articulate their vision and how funds will achieve specific outcomes. Additionally, both funding forms can serve different purposes depending on the business lifecycle stage. A startup might lean toward grants that provide free capital, while established companies might prefer loans for expansion. Ultimately, the right choice depends distinctly on the business needs and financial strategy.

A critical component of understanding funding options involves examining their respective eligibility requirements. Loans usually necessitate thorough financial documentation and credit evaluations before approval. Borrowers must provide comprehensive evidence of their financial state, including balance sheets, income statements, and existing debts. This detailed assessment helps lenders determine the borrower’s ability to repay. As a result, businesses with strong credit histories tend to receive favorable loan terms. Conversely, grant eligibility can vary widely depending on the funding source. Various grants may target specific industries, demographics, or purposes, such as innovation or environmental sustainability. This means businesses need to conduct extensive research to identify grants that are beneficial for them. Additionally, many grants require detailed project proposals that outline how funds will be used, expected outcomes, and timelines. This requirement can be equally demanding and calls for strategic planning. In some instances, businesses may find that the eligibility criteria for grants are less transparent than those for loans, making it imperative to seek mentorship or resources to navigate the application process successfully.

Compliance and Reporting Obligations

Both loans and grants necessitate compliance and reporting obligations, albeit in differing ways that significantly affect business operations. When businesses are awarded loans, lenders typically impose conditions for maintaining operational standards. Regular financial reporting and documentation must prove that businesses effectively manage loaned capital. Failure to comply may result in penalties, including increased interest rates or even the requirement to repay the loan immediately. For grants, recipients must adhere to specific reporting obligations to ensure compliance with the terms set out in the initial agreement. This may include submitting progress reports, financial statements, and evaluations of how grant funds are spent. Regular audits can also be conducted by the granting agency to verify compliance. Due to these obligations, businesses must allocate resources or personnel to manage these tasks meticulously. Effectively adhering to these compliance measures can build a strong relationship with lenders or grantors, potentially paving the way for future funding opportunities. Therefore, understanding these ongoing obligations is fundamental for businesses that aim to sustain any funding received while meeting legal expectations.

The implications of defaulting on loans and grants can differ significantly, affecting the overall health of a business. When a business defaults on a loan, it risks severe monetary consequences, including penalties or foreclosure on collateral used as security. Default can also lead to irreparable damage to the business’s credit score, causing long-term issues securing future financing. A diminished credit rating can hinder growth opportunities and strain relationships with suppliers and partners. In contrast, defaulting on grants can lead to different types of repercussions. Grant recipients who do not comply with conditions may find themselves obligated to return funds awarded or face legal action from the issuing body. Also, losing grant funding can significantly impact projects, especially if they rely solely on that financial support. Therefore, understanding the consequences of defaulting is essential. Both loans and grants contain legal language that outlines repercussions for defaults, requiring careful consideration of commitment levels. Businesses should consult legal or financial advisors to assess potential risks before accepting any funding.

Strategizing for Success

To navigate the complexities of loans and grants, businesses must develop strategic financial plans tailored to their circumstances. A proactive approach includes thoroughly assessing capital needs, understanding the implications of each funding type, and ensuring compliance with all obligations. Businesses should prioritize building strong financial management systems to streamline reporting and tracking of funds obtained through these avenues. This ensures ongoing compliance and optimizes resource usage. Additionally, businesses can benefit from networking with others who have successfully secured loans or grants, as shared insights can be invaluable. Attending workshops and seminars can also help companies become familiar with best practices in funding applications. Utilizing online resources and databases to identify available grants is crucial for staying informed about funding opportunities in current markets. Furthermore, it is essential to maintain transparent communication with funders, keeping them apprised of project progress or challenges faced. Establishing rapport can lead to further assistance or funding opportunities in the future. By focusing on strategic choices in funding, businesses can set a strong foundation leading to growth and success.

In summary, navigating the legal obligations associated with business loans and grants requires businesses to consider various factors carefully. Each option presents a unique set of opportunities and challenges, making it vital to understand how they align with your business goals. Loans offer a straightforward path to immediate capital but come with rigid repayment and compliance requirements. Conversely, grants can provide essential funding without repayment obligations, though they may involve complex eligibility criteria and rigorous reporting standards. Companies looking to leverage these funding types must prioritize sound financial planning and compliance to ensure success. Engaging with experienced professionals can also provide valuable insights into managing these obligations effectively. Regardless of your choice, emphasizing legal aspects and compliance will foster trust with funding partners and enhance your business’s credibility and reputation. By strategically navigating these obligations and requirements, you can position your business for growth, sustainability, and resilience in a competitive marketplace. This proactive effort ultimately paves the way for achieving your business vision and long-term success.

Furthermore, businesses should regularly assess their funding strategies as market conditions and financial landscapes shift over time. By staying informed about new financing trends and adapting to changing environments, they can position themselves better for future opportunities. Then adjusting these strategies ensures that companies can optimize available resources effectively. This includes being mindful of the evolving regulations surrounding loans and grants, allowing businesses to stay ahead of compliance requirements. Moreover, establishing clear internal controls for managing funding can lead to increased accountability and more effective allocation of resources. Keeping thorough records and preparing for potential audits can mitigate risks associated with non-compliance, creating a culture of transparency that benefits the organization. Finally, fostering relationships with financial institutions, grant agencies, and other relevant bodies can open doors to additional funding sources. Building trust with these stakeholders enhances collaboration and elevates the chance of securing future project financing. Remember, effective funding management integrates proactive planning, compliance awareness, and relationship building – all essential components that will help your business navigate the diverse landscape of funding options successfully.