Navigating Customs Procedures in International Business

Engaging in international business necessitates adherence to various customs procedures, which can differ significantly by country. Understanding these regulations is crucial for companies wishing to import and export goods efficiently. Traditionally, customs regulations encompass multiple aspects such as tariffs, import quotas, and trade agreements that influence the flow of international goods. Without proper knowledge, businesses could experience delays, increased costs, or even legal repercussions. As such, gaining insight into customs procedures is essential. Moreover, businesses should consider seeking assistance from trained customs brokers or consultants who can navigate the complexities of customs knowledge expertly. Their expertise can streamline procedures and ensure compliance with local regulations. In addition, governments often provide resources and tools online to help businesses familiarize themselves with customs requirements. Utilizing these resources can lead to a more efficient process. Furthermore, incorporating technology solutions can enhance customs management, making it easier for companies to comply with international regulations. Therefore, businesses must prioritize a thorough understanding of customs regulations and the tools available to help manage the requirements effectively. Ultimately, navigating customs successfully can lead to better trade relationships and remove barriers in international markets.

When preparing to engage in international trade, it is imperative to understand the specific documents required for customs clearance. Various trade documents include the Commercial Invoice, Packing List, Bill of Lading, and Certificate of Origin, among others. Each document carries vital information regarding the shipment, which helps customs officials assess duties, tariffs, and the legality of the goods being imported or exported. Additionally, ensuring these documents are correctly prepared can prevent delays and unnecessary costs at the port of entry. Mistakes in documentation may lead to shipments being stuck in customs, resulting in increased warehousing fees and loss of revenue opportunity. Businesses should create a checklist that includes all necessary documents for any given shipment to streamline the process. Fostering good relations with customs authorities through clear and timely communication is also essential. This could involve regularly updating them regarding changes in shipment status or documentation. Furthermore, businesses are encouraged to conduct audits of their documentation processes regularly. This audit ensures that each document complies with international regulations and avoids any potential issues. Ultimately, thoughtful preparation of the required documentation lays the groundwork for smoother international trade operations.

Understanding Tariffs and Duties in Trade

Tariffs and duties are significant components of customs procedures that international businesses must comprehend thoroughly. A tariff is essentially a tax imposed by a government on imported goods, and it can vary based on the type of goods, country of origin, and trade agreements in place. Understanding the applicable tariffs is crucial for calculating the total cost of importing goods. Duties, on the other hand, refer to the fees levied on specific imported items, which can further affect a company’s profit margins. International businesses should utilize resources such as the Harmonized System (HS) Code, which classifies products for customs purposes and determines the corresponding tariff rates. This system standardizes tariffs globally, helping businesses avoid misclassification penalties. It is also essential to monitor changes in tariffs consistently, as governments may adjust rates based on economic conditions or trade negotiations. Therefore, businesses should actively follow trade policies and tariff regimes of their trading partners. Staying informed and adaptable can help companies develop strategies that minimize their cost implications and protect their bottom lines. Ultimately, a comprehensive understanding of tariffs and duties plays a vital role in the success of international business ventures.

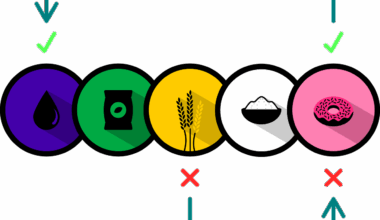

In addition to understanding tariffs and duties, exporters should be well-versed in import/export licenses and permits required by various countries. Each country may have unique restrictions on certain items, necessitating specific licenses or permits to facilitate legal importation or exportation. This requirement can complicate the trade process and, if overlooked, can lead to severe penalties, including fines or confiscation of goods. Navigating this landscape requires thorough research and often consultations with local authorities or trade experts equipped to provide guidance. Moreover, countries may have regulations in place that classify certain items as restricted, controlled, or even prohibited. Understanding these classifications is crucial for maintaining compliance and avoiding legal trouble. Additionally, businesses must also consider any special licenses associated with certain products like firearms, chemicals, or pharmaceuticals, which may require additional vetting or bureaucracy. Taking a proactive approach by checking specific requirements prior to exporting and importing goods can save businesses time and money. Furthermore, automating checks for licenses and permits can streamline compliance processes. Ultimately, ensuring that all necessary permits and licenses are secured is paramount for smooth operations in international trade.

Role of Free Trade Agreements

Free Trade Agreements (FTAs) play a crucial role in shaping customs procedures for international business transactions. FTAs typically reduce or eliminate tariffs on goods traded between countries, which can significantly lower costs for businesses operating in multiple markets. Understanding the specifics of these agreements is essential for maximizing the benefits associated with international trade. Countries often negotiate FTAs to promote substantial trade flows, enhance economic cooperation, and attract investment. It is advisable for businesses to assess the FTAs between their home country and their target markets since these agreements can simplify customs procedures. Some FTAs also include provisions that address non-tariff barriers, contributing to smoother trade processes. Companies need to stay updated on existing and upcoming FTAs, as changes in trade policy could sharply impact operations. Businesses should also take time to adapt their supply chains to capitalize on lower tariffs or altered regulatory obligations brought about by new agreements. Additionally, utilizing FTAs can necessitate obtaining certificates of origin or other documentation to validate eligibility for reduced tariffs. Ultimately, properly leveraging FTAs can foster growth in international business while enabling efficient customs procedures.

As international trade grows increasingly complex, leveraging technology for customs compliance becomes essential. Various software solutions automate customs procedures, significantly reducing errors in documentation and streamlining clearance processes at borders. Technologies like blockchain, artificial intelligence, and cloud computing help businesses maintain accurate records more efficiently, safeguarding against compliance risks. Additionally, these tools provide access to real-time data for tracking shipments, which can facilitate quicker responses to any customs inquiries. Many software solutions also come integrated with databases that hold customs information, allowing businesses to stay informed about changes in regulations or tariffs. Moreover, adopting technology also supports better communication and collaboration with customs authorities. Companies can share information seamlessly, which can improve clearance times and build stronger relationships with customs officials. Utilizing electronic data interchange (EDI) is another effective way to transmit documents securely and quickly. Embracing digital transformation in compliance processes not only reduces the workload but also accelerates the pathway for goods entering foreign markets. Ultimately, technology has emerged as a critical asset for companies to navigate customs procedures effectively while ensuring compliance with international regulations.

Conclusion

The need for thorough understanding and strategic navigation of customs procedures in international business is undeniable. Companies must prioritize developing expertise in trade documentation, tariffs, and regulatory compliance to succeed in the global marketplace. Establishing strong relationships with customs authorities, leveraging technology, and staying informed about trade regulations develop a solid foundation for effective customs management. Additionally, monitoring free trade agreements can enable organizations to benefit from preferential treatment in contractual obligations. Collaborating with skilled customs brokers or trade specialists may also enhance efficiency in operations, particularly for businesses new to international trade. With proper attention to customs processes, businesses can mitigate the potential of penalties and lost revenue due to non-compliance. Furthermore, an emphasis on leveraging technology can lead to improvements in both speed and accuracy of customs proceedings. The journey of navigating customs procedures may be complex, but embracing these aspects can yield substantial returns in economic opportunities and growth. Ultimately, businesses that invest time and effort into mastering these diverse components will be better positioned to thrive in international business and extend their reach without incurring unnecessary risks.

Engaging in international business necessitates adherence to various customs procedures, which can differ significantly by country. Understanding these regulations is crucial for companies wishing to import and export goods efficiently. Traditionally, customs regulations encompass multiple aspects such as tariffs, import quotas, and trade agreements that influence the flow of international goods. Without proper knowledge, businesses could experience delays, increased costs, or even legal repercussions. As such, gaining insight into customs procedures is essential. Moreover, businesses should consider seeking assistance from trained customs brokers or consultants who can navigate the complexities of customs knowledge expertly. Their expertise can streamline procedures and ensure compliance with local regulations. In addition, governments often provide resources and tools online to help businesses familiarize themselves with customs requirements. Utilizing these resources can lead to a more efficient process. Furthermore, incorporating technology solutions can enhance customs management, making it easier for companies to comply with international regulations. Therefore, businesses must prioritize a thorough understanding of customs regulations and the tools available to help manage the requirements effectively. Ultimately, navigating customs successfully can lead to better trade relationships and remove barriers in international markets.