The Evolution of Mobile Payment Solutions: From SMS to Apps

Mobile payment solutions have significantly transformed our transaction methods. Starting with SMS payments, they paved the way for a new era in commerce. Initially, SMS was used primarily for purchasing ringtones or simple digital content. As mobile technology progressed, businesses began recognizing the potential of leveraging text messages on a larger scale. Partners such as banks and payment providers saw opportunities to facilitate payments through SMS by integrating secure processing systems. SMS transactions were relatively straightforward for users, who could send payment confirmations via text messages without requiring advanced technology. However, limitations arose with transaction types and sums, and security became a concern. Despite these challenges, SMS laid a strong foundation for future advances. As consumer habits shifted, developers looked for improved solutions that matched the growing demand for convenience and security in financial transactions. Newer platforms emerged, such as mobile wallets and applications, providing enhanced functionality with robust security measures. This evolution indicates that mobile payment solutions will continue to grow, incorporating innovations and addressing previous issues while making transactions more seamless and accessible for users worldwide.

Advancements in Mobile Technology

As mobile technology advanced, so did the capabilities behind mobile payment solutions. The shift from SMS payments to mobile apps marked a crucial change in user experience. Smartphone adoption skyrocketed, delivering more sophisticated platforms designed for transactions. Mobile apps offered an extraordinary advantage over traditional SMS, accommodating a more extensive range of services including direct bank transfers, e-commerce integration, and in-store payments. Users appreciated enhanced security features, like biometric authentication and encryption measures, ensuring their financial data was safeguarded. Payment app providers were also able to incorporate loyalty programs and virtual cards, encouraging user engagement and retaining customer loyalty. Today, platforms like Apple Pay, Google Pay, and Samsung Pay illustrate the advantages of usability and security. With frequent updates and improvements, these apps provide seamless transactions for users worldwide. They integrate advanced technologies such as Near Field Communication (NFC) and contactless payment systems, making it incredibly easy for consumers to transact anytime, anywhere. Businesses realized that adopting mobile payment solutions could streamline their operations while attracting a tech-savvy customer base eager for innovative purchasing experiences.

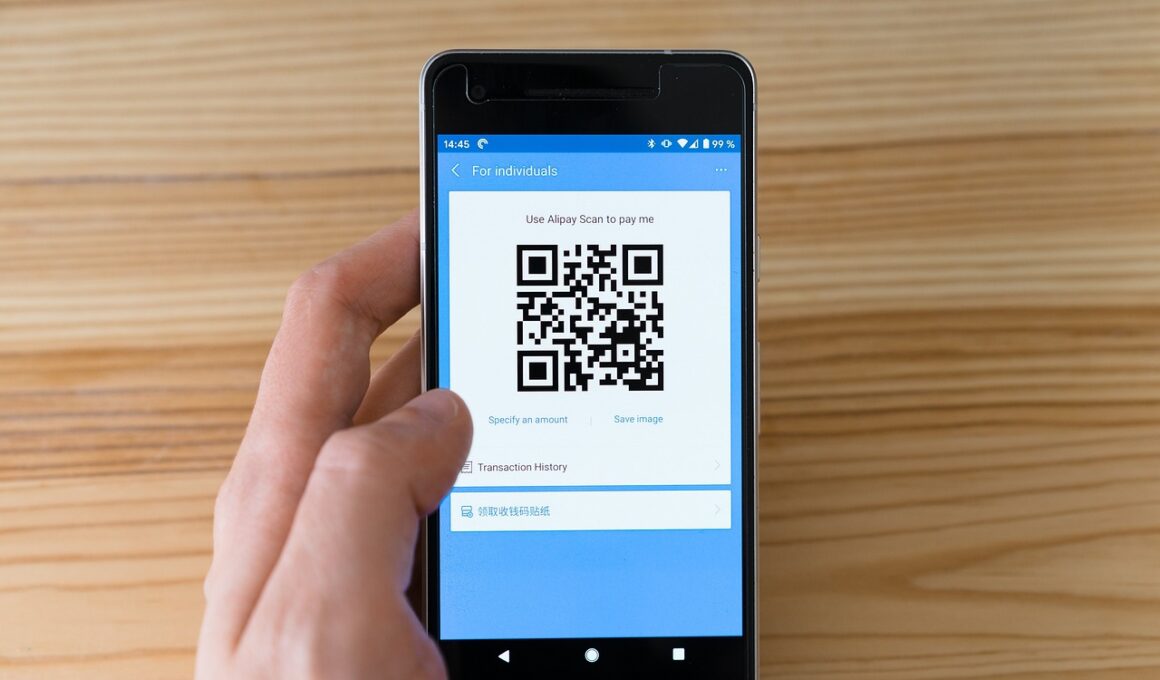

The rise of e-commerce has further propelled the demand for mobile payment solutions. Online shopping represents a significant portion of retail sales, leading consumers to seek accessible payment methods. When making purchases on e-commerce platforms, users benefit from mobile payment solutions that offer a seamless checkout experience. Payment apps link directly to various digital wallets, making transactions swift and secure. Additionally, mobile features like one-click payment options have streamlined the shopping process, reducing cart abandonment rates significantly. Retailers also started integrating QR code-based payment solutions, allowing customers to pay using their smartphones easily. The ability to scan a QR code at checkout has drastically simplified payment for goods and services. E-commerce platforms have partnered with mobile payment providers to enhance overall user satisfaction and minimize friction during transactions. This partnership has proven mutually beneficial, as businesses gain a competitive edge while consumers achieve a more enjoyable shopping experience. Mobile payment solutions have thus become essential for the modern retail environment, driven by the growing influence of technology and changing consumer preferences.

The Role of Digital Wallets

Digital wallets have become integral components of mobile payment solutions. They offer users a convenient way to store multiple payment options in one application. Through digital wallets, consumers can save credit or debit card information securely, making transactions faster at the point of sale. Furthermore, digital wallets often include features that allow users to track spending and access loyalty rewards seamlessly. A significant advantage of mobile wallets is their ability to facilitate in-app purchases without re-entering payment details. Many businesses recognize the potential of digital wallets as a marketing channel, allowing them to send targeted offers directly to customers. This dynamic allows businesses to cultivate strong customer relationships and personalize user experiences. Additionally, leading digital wallets continuously update their platforms, introducing features such as peer-to-peer transfers and cryptocurrency support. These advancements demonstrate their commitment to remaining relevant in a rapidly evolving digital landscape. As digital wallets further integrate with social media and messaging apps, they are set to reshape how we think about transactions and financial management in the future.

Security remains a paramount concern as mobile payment solutions evolve. Since financial transactions are prone to exploitation, adopting robust security measures is crucial for user confidence. Companies implementing mobile payment systems invest heavily in cybersecurity. Features like biometric authentication, two-factor authentication, and end-to-end encryption have added layers of protection against potential threats. Users must always be aware of best practices when opting for mobile payment solutions. For example, they should ensure their devices are secure, use strong passwords, and make updates regularly. Additionally, keeping software up to date can mitigate risks associated with vulnerabilities. The convenience offered by mobile payments should not outweigh the importance of security. Financial institutions, alongside technology providers, must communicate the significance of staying vigilant. By working collaboratively, merchants can build a secure ecosystem that makes consumers feel comfortable using mobile payment solutions regularly. Though advancements in technology often bring challenges, the focus must remain on safeguarding users’ sensitive information while providing seamless services. This balance is key to ensuring ongoing growth in the mobile payments sector as technology continues to innovate and streamline processes.

The Future of Mobile Payments

The future of mobile payment solutions appears promising, with continuous advancements on the horizons. Emerging technologies such as blockchain and artificial intelligence are set to reshape the landscape further. Blockchain technology offers enhanced security and transparency, creating an ideal framework for mobile payments. Many businesses are starting to explore its potential to execute secure transactions without intermediaries, which could drastically reduce transaction fees. Additionally, artificial intelligence can help personalize the user experience by analyzing spending habits to offer tailored promotional offers and rewards. As machine learning algorithms improve, they will help businesses target customers more effectively and retain their loyalty. Moreover, advancements in Internet of Things (IoT) could enable further integration, allowing customers to make payments seamlessly through smart devices. From wearables to connected vehicles, the future of payments may not rely solely on smartphones. Furthermore, as global mobile network infrastructure expands, developing countries will increasingly adopt mobile payment solutions. There is tremendous potential for financial inclusivity, allowing the underserved populations access to secure transactions. As we navigate this evolving landscape, it is essential to keep user experiences and security measures at its core to drive sustainable growth.

In conclusion, the evolution of mobile payment solutions has transformed the way consumers and businesses approach transactions. From the early days of SMS payments to advanced mobile wallets, this journey has emphasized innovation and security. The influx of digital transactions introduces convenience, yet balancing security is crucial for maintaining consumer trust. Mobile payment solutions have reshaped the retail industry by facilitating e-commerce growth and enhancing customer engagement through personalized experiences. As technology progresses, security measures become more robust and accessible, allowing users to feel secure when conducting transactions. The future is ripe for potential advancements driven by cutting-edge technologies like blockchain and AI, indicating that mobile payments will only gain traction in the coming years. Ultimately, it is the adaptability of companies that will determine whether they thrive or struggle in an increasingly mobile-centric marketplace. By continuously evolving and embracing changes, businesses can better meet consumer needs and preferences while enhancing profitability and growth. As mobile payment solutions continue expanding, they stand to redefine financial transactions, ensuring that convenience and security remain essential aspects that drive their development.

Impact of Mobile Payments on Daily Life

Mobile payments are changing everyday life for consumers immensely. With just a tap or click, users can make transactions without needing cash or cards. This convenience has led to a shift in how people view money management. Consumers now prioritize speed and ease of access when making purchases, indicating a clear trend toward digital solutions. Mobile payment options encourage users to manage their finances more efficiently, as accounts can be monitored in real-time directly from their smartphones. Furthermore, the integration of budgeting tools within payment applications facilitates enhanced financial planning for users. By providing insights into spending patterns and trends, users can make informed decisions about their finances. Access to digital receipts also simplifies record-keeping and expense tracking, eliminating the clutter of paper documents. The ease of mobile payments empowers users to shop confidently, whether in-store or online. This cultural shift toward mobile transactions has influenced vendors to adopt these technologies, thus creating competitive advantages. Overall, mobile payments are not just about convenience but also about building a more inclusive financial ecosystem, appealing to diverse consumer needs and preferences across the globe.