How to Conduct a Payroll Audit

Conducting a payroll audit is a crucial process for any business that wants to ensure compliance and accuracy in its payroll practices. A payroll audit helps identify discrepancies and ensures that employees are paid accurately and on time. The first step in conducting an audit is to gather all relevant payroll records, including employee timesheets, tax documents, pay rates, and benefits information. This data serves as a foundation for the audit and should be organized for easy access and review. Make sure to include any contracts or agreements that pertain to employee compensation, as these can provide insight into payroll practices. Additionally, payroll software may have features that assist in the audit process, so leverage these resources where appropriate. An effective payroll audit can uncover issues related to overtime calculations, incorrect deductions, and misclassification of employees, all of which could lead to penalties or lawsuits if unaddressed. By taking the time to conduct a thorough audit, businesses can mitigate risks and ensure that their payroll is not only compliant but also valuable and transparent.

In order to effectively conduct a payroll audit, you will need to implement a structured approach. Begin by examining the pay structure and the categorization of your employees. Verify that employees are classified correctly as either exempt or non-exempt, as this distinction impacts overtime eligibility and compliance with wage laws. Another essential part of the audit is to cross-reference timesheet data with payroll records. Ensure that the hours reported match the hours paid to employees. This step requires careful attention, as even minor discrepancies can lead to significant issues down the line. Additionally, corroborate that all tax withholdings are accurate, including Social Security, Medicare, and federal and state income tax. This verification helps to avoid issues with the IRS and state tax authorities. You may also want to review employee benefits and ensure that all deductions made from paychecks are valid and comply with federal and state regulations. An effective audit requires meticulous attention to detail, as it’s the small elements that often lead to larger problems.

Review Each Component of Payroll

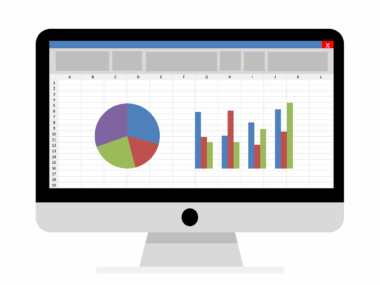

As you continue through the audit process, it is essential to review each component of payroll systematically. Begin with base salaries and hourly rates to ensure they align with employment agreements. Verify that any bonuses or commission structures are supported by documentation and comply with the relevant policies. You should also examine the methods used for calculating overtime pay to ensure accuracy. Check if proper rates are applied depending on the employee’s classification and hours worked. It’s also vital to assess any applicable deductions or benefits contributions, ensuring that each deduction aligns with company policy and employee agreements. For example, confirm that retirement contributions are calculated based on the correct salary figures. Lastly, inspect payroll processing records for any errors or anomalies. Errors might occur due to human oversight or software issues, both of which need to be addressed. A meticulous review at this stage ensures the integrity of the payroll disbursement process, reducing the likelihood of errors in the future.

Communication plays a key role in a successful payroll audit. Be sure to involve key stakeholders by sharing findings with department heads, finance teams, and payroll staff. This collaborative effort can lead to enhanced insights and allow for the identification of any underlying problems or common practices that may need to change. Communicating the findings also helps create an atmosphere of accountability within the organization, which is vital for maintaining compliance. It’s a good practice to document the audit findings comprehensively, outlining any discrepancies or irregularities discovered during the process. A well-documented audit report can serve as a reference for future audits and protect the business against potential disputes or claims. After sharing the findings, schedule a follow-up meeting to discuss action items or recommendations for improvement. Implementing changes based on the audit results can not only improve payroll accuracy but also foster a culture of compliance within the organization, where employees feel assured that payroll matters are handled with the utmost care.

Implementing Changes and Making Improvements

Once an audit is completed, it often uncovers areas for improvement in payroll processes. Based on the findings, it’s crucial to take immediate action to rectify any discrepancies identified. Prioritize addressing any issues related to payroll accuracy, documentation, or compliance. Review and update policies that govern payroll practices, and ensure that all employees are trained and informed about these changes. For instance, if the audit revealed challenges with employee classification, consider holding workshops or training sessions to ensure payroll staff are adequately educated on compliance standards. Additionally, monitor the performance of the proposed changes, ensuring that they effectively reduce errors and improve the audit process in subsequent cycles. Using technology can also enhance payroll accuracy, so explore software solutions that streamline payroll processes while maintaining compliance. Automating certain elements can reduce human error and improve overall efficiency. Additionally, periodic audits should be scheduled—consider establishing a routine audit process, whether annually or semi-annually, to continually assess compliance and maintain accuracy in payroll management.

In conclusion, conducting a payroll audit is not just an administrative task; it is a critical component in maintaining compliance and accuracy for any business. The findings from a payroll audit can help business leaders make informed decisions regarding employee compensation and taxation. Furthermore, a thorough audit process helps avoid costly penalties and fosters a culture of transparency and accountability within the organization. By investing time and resources into the payroll audit process, organizations can pinpoint weaknesses that may otherwise remain hidden, leading to more streamlined operations in the payroll department. Moreover, consistent audits can empower employees with better understanding of their compensation and benefits, enhancing morale within the workplace. As businesses navigate evolving labor regulations and taxation laws, proactive audits are paramount to ensuring adaptation and compliance. Engaging trained payroll professionals or consulting external auditors can also provide additional insights and expertise. In doing so, organizations can better prepare themselves for future audits, safeguard operations, and contribute to a positive workplace environment.

Final Thoughts on Payroll Audits

To summarize, payroll audits serve as indispensable tool that provides assurance to businesses. The associated practices contribute significantly to maintaining financial integrity and employee satisfaction. A successful payroll audit encompasses a thorough review of all payroll components, focused communication, and proactive engagement in correcting and streamlining processes. By recognizing discrepancies, implementing recommendations, and scheduling future audits, businesses position themselves for greater compliance and minimal risk. These audits not only protect the organization legally and financially but also cultivate a healthy relationship between employers and employees. Result-oriented processes lead to a lower likelihood of disputes related to payroll, ultimately improving workplace morale. Therefore, organizations are encouraged to view payroll audits as an opportunity, rather than a chore. Engaging in regular audits also allows for a more strategic approach to managing payroll and employee relations, paving the way for sustainable growth in a competitive marketplace. Hence, companies that embrace payroll auditing as part of their operational strategy will find themselves better equipped to innovate and adapt to changing norms within the business sector.

In conclusion, understanding the importance of payroll audits cannot be overstated. Audits ensure accountability, accuracy, and compliance while protecting businesses from legal and financial repercussions. Furthermore, conducting payroll audits presents an opportunity to enhance operational efficiency and solidify employment relationships. As labor laws evolve, keeping a close eye on payroll processes ensures that organizations remain compliant and responsive to both regulatory changes as well as employee needs. By dedicating attention to thorough payroll audits and the necessary follow-ups, businesses can foster a sense of financial and managerial confidence among their leadership teams and employees alike. This ongoing vigilance leads to an empowered organization where both management and staff understand their roles in addressing payroll concerns. Paying close attention to the mechanics of payroll systems can lead to greater transparency, satisfaction, and retention among employees. Lastly, businesses that prioritize payroll accuracy will reap the benefits of trustworthiness and positive reputations within their industries. This ultimately translates into improved performance and success in a competitive landscape, laying the foundation for sustainable operational practices moving forward.