The Role of Reverse Factoring in Supply Chain Finance

Reverse factoring is essential in the realm of supply chain finance, fundamentally altering how companies manage their cash flow. This financial mechanism connects suppliers and buyers, enabling suppliers to receive early payments on their invoices. Essentially, it reduces the time between the delivery of goods and payment, fostering a healthier cash flow for suppliers. Companies can utilize this approach to strengthen relationships with their suppliers, creating a ripple effect of efficiency throughout the supply chain. Moreover, reverse factoring offers security to suppliers, who may otherwise struggle with long payment cycles that can jeopardize their operational stability. The growing adoption of reverse factoring is also driven by its ability to optimize working capital for buyers. With reduced pressure on cash reserves, companies can invest those savings back into growth initiatives. Their suppliers benefit from enhanced liquidity, ensuring that they can continue to operate smoothly. In today’s volatile market, having access to prompt payments can mean the difference between success and failure for smaller suppliers. Therefore, reverse factoring not only assists in meeting immediate financial obligations but also encourages long-term strategic partnerships that benefit all parties involved in the supply chain.

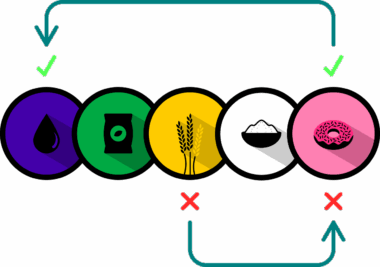

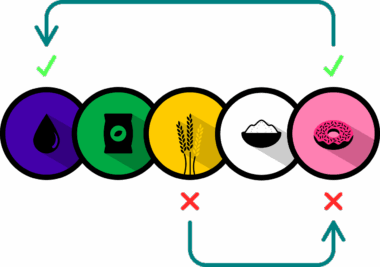

Understanding the mechanics of reverse factoring reveals why it’s become a pivotal aspect of modern supply chain finance. The process begins when a buyer approves an invoice from a supplier. Instead of the supplier waiting for the traditional payment period to elapse, a financial institution or bank steps in to pay the supplier promptly. This early payment allows the supplier to maintain liquidity while the buyer retains control over their cash for a longer duration. Financial institutions charge a fee for this service, but often, the cost is lower than traditional financing options. This setup is particularly favorable for larger companies with strong credit ratings, as they can negotiate better terms, benefitting their suppliers even further. Consequently, suppliers are incentivized to offer discounts for faster payments, enhancing profitability for both parties. Additionally, reverse factoring can be customized based on a company’s supply chain structure, ensuring scalability. Such flexibility makes it a valuable tool for organizations seeking to enhance financial relationships. In summary, when executed effectively, reverse factoring transforms the dynamics between buyers and suppliers, leading to a win-win situation that bolsters supply chain resilience.

The impact of reverse factoring on supplier relationships cannot be overstated—it has the potential to cultivate more collaborative partnerships between businesses. By banks or financial institutions facilitating payments on behalf of buyers, suppliers can experience a significant reduction in payment-related stress. This financial tool not only promotes faster cash flow but also enables suppliers to better plan their resources and inventory levels. As a result, suppliers often report higher levels of satisfaction due to more predictable cash inflows. This satisfaction translates into loyalty, which is vital in a competitive marketplace. Suppliers are more likely to prioritize fulfilling contracts for buyers who provide reliable payment terms through reverse factoring. Consequently, this financial practice also minimizes the risk of supply chain disruptions. When suppliers are stable and reliable, buyers can trust that their products will arrive on time and meet quality standards. Furthermore, the ripple effect of stable suppliers contributes to overall supply chain efficiency. Improved supplier relationships also allow for better communication regarding demand forecasts and product development. This shared insight can lead to innovation and responsiveness that goes beyond financial transactions, embracing a more holistic approach to collaboration.

Benefits of Reverse Factoring for Buyers and Suppliers

For buyers, engaging in reverse factoring offers substantial advantages beyond immediate cash flow management. One of the primary benefits is the potential for enhanced negotiating power with suppliers. With the option for early payments, buyers can leverage this advantage when discussing pricing or contract terms. Suppliers, who gain access to cash sooner, are often more willing to offer discounts or better pricing structures. Furthermore, buyers can improve their financial statements through optimized working capital management. By ensuring that payables extend while receivables improve, they can present a healthier balance sheet to stakeholders. Additionally, as cash flow becomes more predictable, buyers can allocate resources for growth, research, and development initiatives. This strategic investment leads to long-term competitive benefits, making reverse factoring a wise consideration. Investments in technology or processes can stem from the savings generated by favorable payment terms. Beyond financial stability, reverse factoring conveys a commitment to supplier partnerships, positioning buyers as willing contributors to supplier success. Ultimately, integrating reverse factoring into supply chain finance underlines a shift toward collaboration and innovation in the industry.

Data transparency and analytics are another crucial aspect of reverse factoring, significantly benefiting both parties involved. Companies utilizing reverse factoring can leverage insights gained from transaction data to drive key decisions. This information includes payment history, supplier reliability, and performance metrics, which are useful not only for financial assessments but also for operational improvements. By analyzing historical data, companies can identify trends in supply chain performance, allowing them to react more promptly to fluctuations in demand. Understanding suppliers’ cash flow needs can also facilitate building stronger strategic partnerships. This data-driven approach fosters a culture of trust, as all parties engage in transparent discussions. Moreover, technology advancements deliver platforms for buyers and suppliers allowing them to view real-time payment statuses, which enhances overall satisfaction. The predictive capabilities derived from analyzing data can inform better long-term procurement strategies, helping companies become more adaptable amidst economic shifts. Embracing these analytics enables organizations to navigate complexities in supply chains, focusing on efficiencies and cost reductions over futures driven by uncertainty. Ultimately, adopting a data-centric approach will further reinforce the role of reverse factoring in supply chain finance.

However, challenges do arise with the integration of reverse factoring in supply chain finance. For one, not all suppliers may have access to the same financing options or may not be aware of reverse factoring as a solution. This gap can create discrepancies in supply chain performance, leading some suppliers to miss out on valuable opportunities for liquidity. Additionally, the selection of financial partners is critical; companies need to ensure that they choose credible institutions that align with their values and operational goals. There may also be concerns regarding fees associated with early payment programs, which could dissuade suppliers from participating. While reverse factoring typically presents lower costs compared to traditional financing, buyers and financial institutions must communicate these costs clearly to prevent misunderstandings. Furthermore, regulatory changes can impact the feasibility and attractiveness of reverse factoring arrangements. Companies must remain vigilant and flexible in adapting their strategies to align with evolving market conditions and regulations. Nevertheless, overcoming these challenges typically fosters resilience and adaptability in the supply chain, further enhancing the attractiveness of reverse factoring as a key financial tool.

Future Perspectives on Reverse Factoring

As businesses continue to navigate the ever-evolving landscape of procurement and supply chain financing, the future of reverse factoring appears promising. Demand for flexible financing solutions will likely rise, particularly among small to medium-sized enterprises (SMEs) that often face liquidity challenges. As awareness of reverse factoring grows, more companies may integrate this practice into their financial strategies. Additionally, technological advancements such as blockchain may enhance transparency and streamline operations within reverse factoring processes. Automation and smart contracts could optimize payment terms and enhance real-time monitoring, significantly boosting operational efficiencies. Breakthroughs in financial technology could foster new partnerships between buyers, suppliers, and financial institutions, enabling innovative supply chain solutions. The emergence of digital platforms dedicated to reverse factoring will simplify access for smaller suppliers, ensuring they can benefit from early payments. As the global marketplace becomes increasingly interconnected, reverse factoring can play a vital role in mitigating risks associated with geopolitical and economic uncertainties. Focusing on relationships and collaboration will define the future of supply chain finance. Therefore, the sustainability and effectiveness of reverse factoring depend heavily on maintaining strong partnerships among all stakeholders involved.