Integrating Operational Budgeting with Strategic Planning

Operational budgeting is crucial for organizations as it outlines the planned expenditures and revenue generation for a specific period. It is essential for aligning resources with strategic priorities, ultimately ensuring effective management and control over financial resources. By connecting operational budgeting with strategic planning, companies can ensure that their financial resources support the realization of their long-term objectives. This integration helps in making informed financial decisions that are aligned with the overarching goals of the organization. It is imperative that both operational budgeting and strategic planning are aligned to avoid discrepancies. This alignment allows organizations to respond swiftly to market changes and streamline processes. Effective operational budgeting enables organizations to estimate costs and allocate resources efficiently. Furthermore, organizations can identify key performance indicators that support strategic objectives. This process involves collaboration between finance and operational teams to ensure that all departments understand financial constraints. By fostering communication, the organization can promote a culture of financial awareness and accountability. In doing so, organizations can enhance profitability while managing their operational risk effectively. The combined focus on strategic goals and operational realities ensures sustained growth.

The integration of operational budgeting with strategic planning requires a systematic approach to ensure that financial resources are allocated effectively. Companies often face the challenge of balancing short-term operational needs with long-term strategic aspirations. Developing a clear framework for budgeting entails understanding both immediate operational necessities and broader strategic goals. A collaborative approach involving various departments is essential in creating a comprehensive budget that mirrors the strategic objectives of the organization. This process starts with clear communication of strategic priorities across all levels of management in order to align efforts and resources effectively. Moreover, utilizing data-driven insights can optimize decision-making processes and help build a more resilient organization. It is necessary to adopt an iterative approach to budgeting, ensuring alignment as market conditions evolve. Each department should regularly review its operational budget to ensure it remains conducive to strategic alignment. Additionally, tracking trends and performance metrics helps organizations gauge effectiveness and adjust budgeting accordingly. By embedding this in their culture, organizations can foster a proactive environment that embraces change. Cultivating a mindset focused on budgeting as a strategic tool paves the way for enhanced financial performance.

Importance of Collaboration

Collaboration across various departments is vital when integrating operational budgeting with strategic planning. Each department contributes unique insights and expertise that collectively enhance budgeting accuracy. For successful budgeting, finance teams must work with operations, human resources, and other departments to gather relevant data about resource needs. This multidisciplinary approach promotes transparency and helps in identifying potential discrepancies before they affect the organization’s financial health. Open communication enables teams to share insights about their operational priorities and strategic objectives, facilitating informed decision-making. Regular joint meetings can enable departments to understand each other’s challenges while fostering a collaborative spirit. Additionally, establishing a unified budget can eliminate redundancy and streamline expenditures. Engaging different departments during the budgeting process ensures that the plans created reflect the actual needs of the organization. Having diverse input allows for more realistic projections and avoids possible pitfalls during execution. Additionally, cross-functional collaboration aligns operations with strategic initiatives, ensuring smoother implementation of corporate strategies. Organizations should invest in collaborative tools and platforms that promote real-time sharing of information, ultimately improving budgeting efficiency.

Another critical factor in effectively integrating operational budgeting with strategic planning involves adopting technology to ease the process. Nowadays, advanced budgeting software offers automation features that facilitate real-time tracking and reporting of financial performance. These tools allow organizations to streamline budgeting processes by minimizing manual errors while improving accuracy. Furthermore, technology enables companies to perform financial simulations and scenario analyses, which can enhance strategic decision-making. By leveraging data analytics and visualization, organizations can gain valuable insights into their financial scenarios, making them more agile in their operations. Most importantly, adopting a comprehensive financial dashboard allows stakeholders to monitor performance consistently. These technological advancements promote a culture of continuous improvement in budgeting practices. The integration of technology into budgeting processes not only enhances efficiency but also assists organizations in demonstrating accountability in financial management. Additionally, the insights gleaned from data aids in identifying areas where operational costs can be optimized. Businesses should continuously evaluate and update their budgeting technologies to ensure they meet evolving needs and challenges. Such investments in technology ultimately contribute to better alignment between operational budgeting and strategic objectives.

Measuring Success

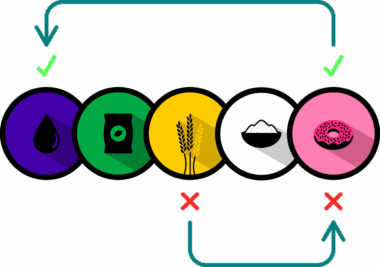

To ensure the successful integration of operational budgeting with strategic planning, organizations must develop effective metrics for tracking progress. Establishing Key Performance Indicators (KPIs) is essential for evaluating how closely budgeting aligns with organizational goals. KPIs provide measurable outcomes that directly reflect the company’s financial performance against its strategic objectives. For instance, metrics such as budget variance and return on investment can guide organizations in assessing the effectiveness of their operational budgets. It is also crucial to conduct periodic reviews to analyze the effectiveness of both budgeting and strategic planning processes. These reviews should encompass an evaluation of the assumptions made during budgeting phases. Regular assessment ensures any deviations from strategic goals are promptly addressed and rectified, leading to greater accountability. Moreover, fostering a culture that appreciates financial performance encourages continuous alignment of resources with strategic objectives. Organizations should also communicate the importance of budgeting to all stakeholders by sharing successes and areas for improvement. This ongoing evaluation principle safeguards the organization from potential financial pitfalls that may arise due to misalignment.

Furthermore, ongoing training and development play a significant role in fostering an environment where operational budgeting aligns seamlessly with strategic planning. Regular workshops and training sessions enhance the skills of team members involved in the budgeting process. By equipping them with the necessary tools and knowledge, organizations ensure that their workforce remains competent in financial management. Continuous professional development encourages staff to remain updated on best practices in operational budgeting and strategic planning. This enables them to contribute effectively and collaboratively during budgeting sessions. Additionally, organizations can benefit from external seminars and conferences that provide fresh insights and innovative strategies in budget management. Encouraging knowledge sharing within departments fosters a culture of collaboration and creativity in developing budgeting strategies. Organizations should create learning platforms that promote the exchange of ideas across different teams. By investing in employee development, organizations will likely see improved financial stewardship throughout the organization. This investment pays off in stronger performance metrics and a more seamless integration of efforts toward new strategic initiatives. Ultimately, a well-trained workforce is essential for achieving operational excellence.

Conclusion

Integrating operational budgeting with strategic planning is crucial for organizational success and sustainability. These processes should not be isolated; rather, their collaboration fosters efficiency, accountability, and a clear direction forward. Organizations must commit to building a culture that perceives budgeting as a strategic framework rather than a mere financial exercise. By prioritizing collaboration across departments, leveraging technology for enhanced accuracy, and establishing clear measures of success, organizations can create a robust foundation for sound financial management. The ultimate goal should be an adaptable budgeting process that remains in sync with shifting market dynamics and the organization’s evolving strategic objectives. Furthermore, organizations need to recognize the value of ongoing training in cultivating a competent workforce capable of effectively navigating complex budgeting practices. Creating a responsive budgeting environment allows for better risk management and ultimately enhances organizational agility. As market changes continue to affect business environments globally, the integration of operational budgeting with strategic planning must be a top priority. By doing so, organizations will be better positioned to thrive and maintain a competitive edge in their respective industries, confirming the critical interlink between operational budgeting and strategic success.